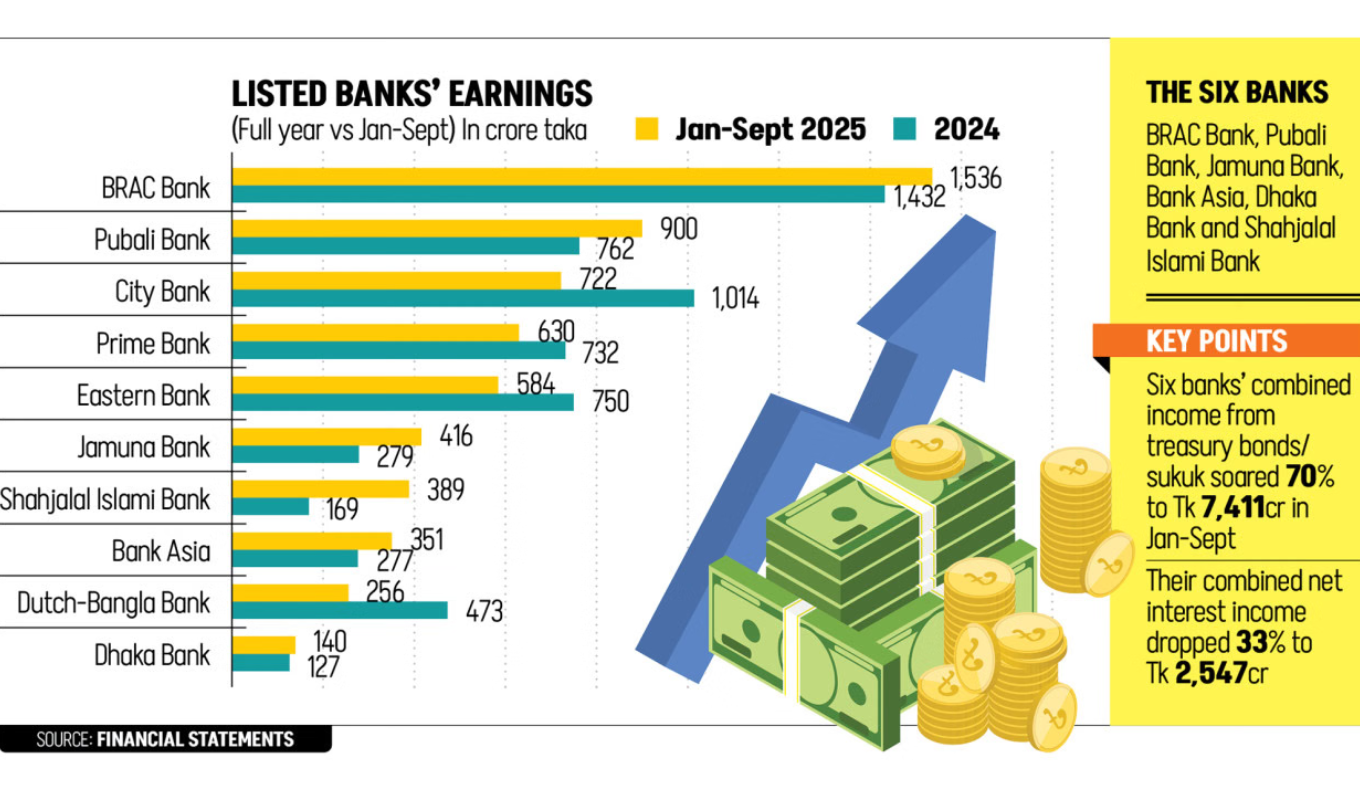

The six banks that recorded nine-month profits surpassing their full-year gains are BRAC Bank, Pubali Bank, Jamuna Bank, Bank Asia, Shahjalal Islami Bank, and Dhaka Bank.

In addition, several other institutions — including Eastern Bank, Prime Bank, and City Bank — which the central bank has recognised as sustainable banks, also achieved notable profit growth during the same nine-month period.

Meanwhile, Islami Bank managed to remain profitable, posting earnings of Tk 99 crore, down from Tk 108 crore in the corresponding period last year.

Treasury Income Boosts Profits Amid Decline in Lending Returns

Despite reduced interest income from lending — traditionally the core of the banking business — the six banks benefitted from strong returns on government securities. Collectively, they earned Tk 7,411 crore from investments, primarily in treasury bonds, marking a 70 per cent increase year-on-year.

However, their combined net interest income fell 33 per cent to Tk 2,547 crore, highlighting the shift away from traditional lending.

“The banking market is highly skewed, so profits vary widely,” said Professor Shah Md Ahsan Habib of the Bangladesh Institute of Bank Management (BIBM).

He noted that the situation deteriorated following last year’s political transition, after which regulatory scrutiny revealed long-concealed non-performing assets.

Mounting Distressed Loans Expose Sector Fragility

Distressed loans in the banking system surged 59 per cent to a record Tk 756,526 crore in 2024, laying bare the fragility of the financial sector. These distressed loans accounted for 45 per cent of total outstanding loans, approximately Tk 1,682,878 crore, an amount nearly equivalent to the national budget for the 2025–26 fiscal year.

According to Bangladesh Bank (BB) data:

- Defaulted loans: Tk 345,765 crore

- Rescheduled loans: Tk 348,461 crore

- Written-off loans: Tk 62,300 crore

“Deposits have shifted from weaker banks to better-governed ones,” Prof Habib observed. “While well-managed institutions attracted higher deposits, the broader business environment remains uncertain.”

He explained that many entrepreneurs have either closed factories or exited the market entirely, leading to a decline in credit demand. Consequently, banks have become increasingly cautious in extending loans and are prioritising debt recovery.

Slowest Credit Growth in Two Decades

Data from Bangladesh Bank for the first two months of the current fiscal year reveal that private sector credit grew by only 6.35 per cent, marking the slowest expansion in over twenty years.

“With limited demand for credit and a shallow bond market, banks have turned to treasury investments to safeguard profitability,” Prof Habib added. “While treasury returns are cushioning earnings, banks should ideally channel more support towards industry and lending to stimulate GDP growth.”

Strong Performers: Bank-wise Breakdown

BRAC Bank

BRAC Bank led the sector with a nine-month profit of Tk 1,536 crore, up from Tk 1,432 crore in 2024. The bank attributed this increase to robust investment income and strong deposit mobilisation, despite subdued loan growth.

Pubali Bank

Pubali Bank posted a profit of Tk 900 crore, compared to Tk 762 crore last year.

Managing Director Mohammad Ali reported improved asset quality and healthy returns from government securities, alongside solid income from international business activities amid signs of economic stabilisation.

Jamuna Bank

Jamuna Bank recorded profits of Tk 416 crore, rising from Tk 279 crore a year earlier. Its financial statements credited the growth to higher investment and other operational income.

Bank Asia

Bank Asia earned Tk 351 crore, up from Tk 277 crore, supported by a sharp rise in investment income, which nearly doubled to Tk 1,930 crore from Tk 979 crore.

Shahjalal Islami Bank

Shahjalal Islami Bank reported profits of Tk 389 crore, more than doubling from Tk 169 crore last year.

Managing Director Mosleh Uddin Ahmed attributed this to stable deposit costs, controlled operating expenses, and strong investment returns. He also cited encouraging performance in export-import trade and predicted continued growth, especially in garment-related sectors.

Dhaka Bank

Dhaka Bank achieved profits of Tk 140 crore, exceeding its full-year 2024 total of Tk 127 crore. The bank reported modest operating profits but noted improved cash flow, driven by rising customer deposits over the past nine months.

Other Notable Performances

While not surpassing their full-year 2024 earnings, several other banks registered solid progress:

- Eastern Bank: Profit up 26 per cent year-on-year to Tk 584 crore.

- Prime Bank: Posted Tk 630 crore, compared with Tk 732 crore last year.

- City Bank: Earned Tk 722 crore.

- Dutch-Bangla Bank: Recorded profits of Tk 256 crore during the same period.

Overall, despite weak lending activity and mounting distressed assets, the banking sector’s strategic shift towards government securities and improved governance among leading institutions has supported earnings resilience in 2025.