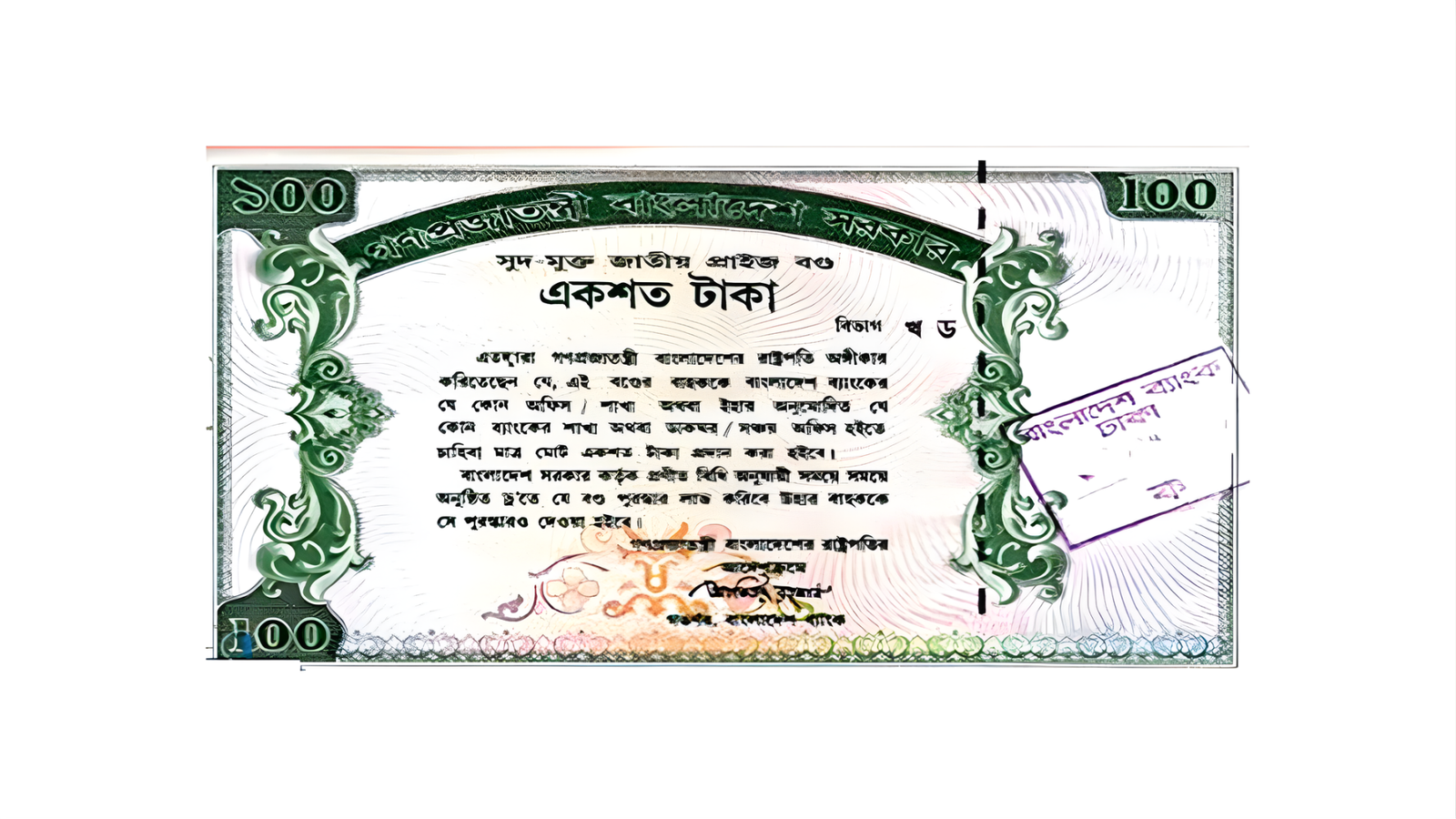

Bangladesh Bank (BB) has taken a significant policy decision to discontinue five long-standing public services, including the sale of national savings certificates and prize bonds. The move is part of a broader strategy to reduce direct public interaction and bring the institution back to its core regulatory and supervisory responsibilities.

According to officials, the other discontinued services include the exchange of damaged banknotes, acceptance of treasury challans, and providing change against challans. The central bank has already notified the Ministry of Finance, and a detailed public announcement is expected to be issued shortly.

The directive is scheduled to take effect from 30 November, after which members of the public will need to rely entirely on commercial banks for these services. For many decades, Bangladeshis have visited the central bank’s Motijheel headquarters and its regional branches to obtain savings tools, exchange notes, or make government payments. The change marks the end of an era in terms of direct public dealings.

Arief Hossain Khan, Executive Director and spokesperson of Bangladesh Bank, informed reporters that these services do not fall under the institution’s fundamental mandate. He emphasised that modern central banks across the world maintain minimal customer-facing operations, allowing them to prioritise monetary policy, financial stability, and banking sector oversight.

However, the BB will continue to offer the exchange of burnt or severely damaged currency notes due to regulatory complexities that make transferring this responsibility to commercial banks impractical.

Some services will remain operational at the 16 designated counters located at the Motijheel headquarters. These include coin exchanges, the sale of commemorative coins, dispute resolution regarding mutilated notes, and certain inter-bank transactions. These services, according to officials, still require centralised handling or specialised verification processes.

Inside sources revealed that newly appointed BB Governor Ahsan H Mansur has been pushing for a structural reform to streamline the organisation and eliminate service areas that could be efficiently managed by the commercial banking network. He has also directed relevant departments to draft a phased plan to gradually discontinue the remaining non-core services.

Similar reforms are expected to be implemented across all branch offices of the central bank situated in other administrative divisions. Officials noted that the objective is not only to reduce operational pressure on the central bank but also to encourage commercial banks to expand and modernise their public service facilities.

The upcoming transition is likely to have a substantial impact on the public, especially elderly citizens and those accustomed to visiting the central bank directly. Financial experts suggest that commercial banks will now need to enhance their customer service capacity to handle increased demand, ensuring a smooth transition without disrupting essential financial activities.