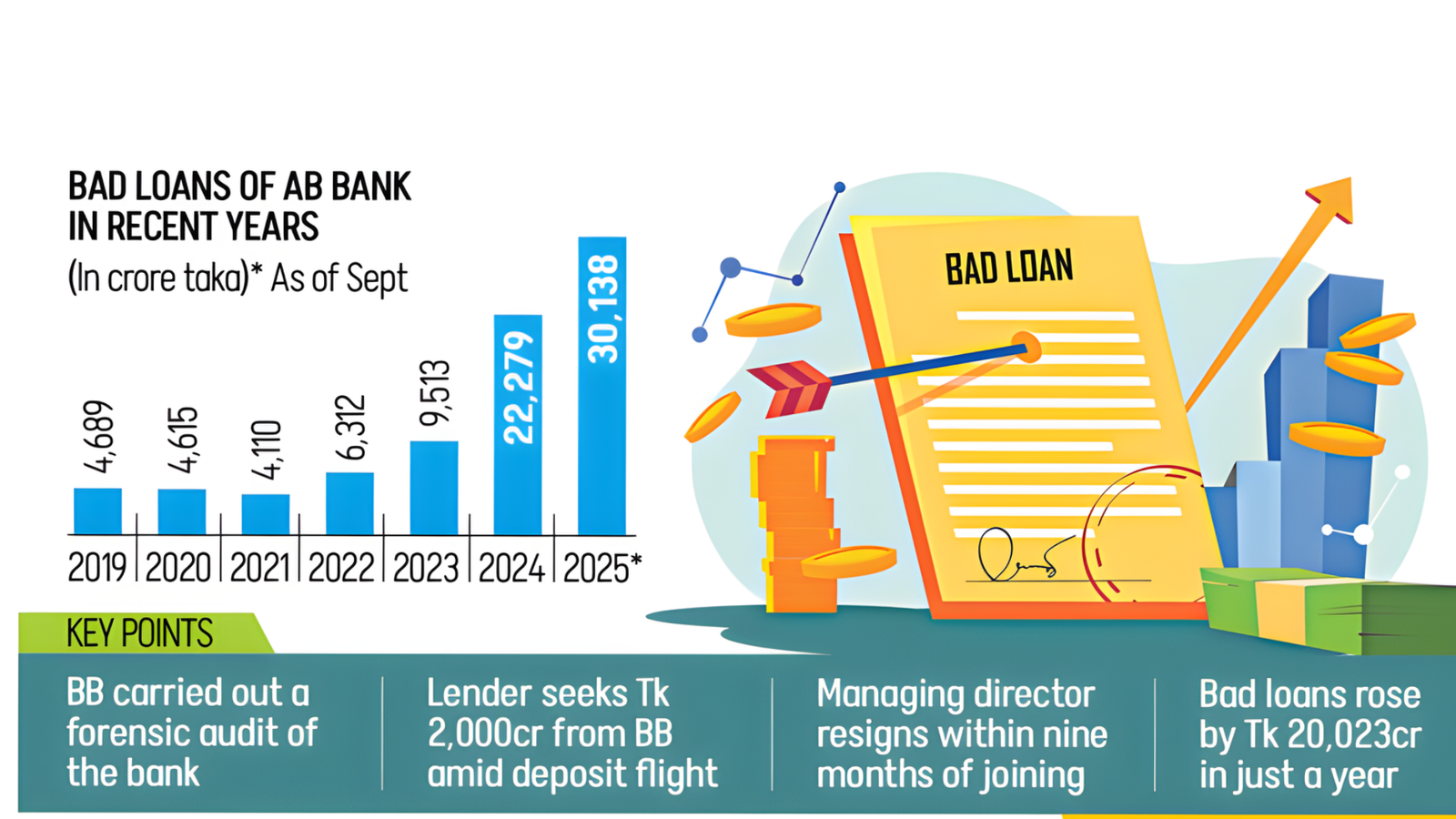

AB Bank’s bad loans have reached an alarming level, with nearly 84% of its total loan portfolio now classified as non-performing loans (NPLs). This signals a severe financial crisis triggered by years of mismanagement at the country’s first private commercial lender.

According to the bank’s latest quarterly report for the period ending in September 2024, AB Bank has outstanding loans amounting to Tk 35,982 crore. Of this, Tk 30,138 crore has been classified as non-performing loans (NPLs), meaning these loans are unlikely to be recovered.

As of September 2024, the bank had Tk 10,115 crore in bad loans, accounting for 31% of its loan portfolio. Officials revealed that Tk 20,023 crore in previously undisclosed bad loans have surfaced within just one year.

The disclosures come at a time when AB Bank is undergoing a forensic audit by foreign auditors, who were appointed based on recommendations from the government’s Banking Reform Task Force. Bangladesh Bank officials stated that the audit has already completed an asset quality review, which includes assessing whether loans have been correctly classified, and will soon submit their findings.

Concealing the Extent of Troubled Assets

Sources familiar with the situation claimed that the bank had been concealing the full extent of its stressed assets for a long time. This was due to irregular management practices, misuse of loan facilities, and an ongoing failure to recover large loans.

For years, the bank maintained the illusion of healthy financials by using temporary loan deferral facilities from Bangladesh Bank – a practice that allowed struggling banks to delay classifying loans as defaults.

Liquidity Crisis: Emergency Support Requested

Amid growing pressure from deposit withdrawals triggered by the audit, AB Bank has requested an additional Tk 2,000 crore in liquidity support from Bangladesh Bank to maintain daily operations. This development comes as the central bank is in the process of merging five distressed banks.

Changes in Top Management

This financial crisis has prompted changes at the top. On November 19, Managing Director and CEO Syed Mizanur Rahman resigned, citing personal reasons. He is expected to join Meghna Bank as managing director, pending approval from the central bank.

Rahman, who had only taken charge in May 2024 after serving as the bank’s additional managing director, told The Daily Star that the bank had previously acquired mortgaged properties from defaulting borrowers and classified them as non-banking assets. This temporary accounting tactic helped reduce the bad loan ratio, as non-banking assets were not included in the NPL count. However, the bank failed to take full possession of these assets due to legal complications, forcing their reclassification as NPLs, which significantly raised the bad loan figure.

AB Bank Faces Growing Losses

AB Bank reported a net loss of Tk 3,113 crore for the first nine months of 2024, compared to a modest profit of Tk 1.58 crore in the same period last year. By the end of 2024, the bank faced a capital shortfall of Tk 4,298 crore, posting a net loss of Tk 1,917 crore.

Founded in 1981 as Bangladesh’s first private commercial bank, AB Bank’s troubles are not new. The bank has faced several issues over the years, including a major money laundering scandal in 2016, which attracted public and regulatory scrutiny.