In a bid to encourage disciplined savings among customers, NCC Bank has introduced a new deposit plan called the “Double Benefit Scheme”, designed to help depositors grow their funds steadily over time. This initiative comes amid a growing trend among Bangladeshi banks offering “money doubling” schemes, which promise to double customers’ deposits under specific conditions.

Traditionally, such schemes fall into two categories: one requires an initial lump-sum deposit along with regular monthly contributions, while the other allows customers to double their investment solely through a single initial deposit. However, many potential investors are unable to make large initial deposits, limiting their access to these schemes.

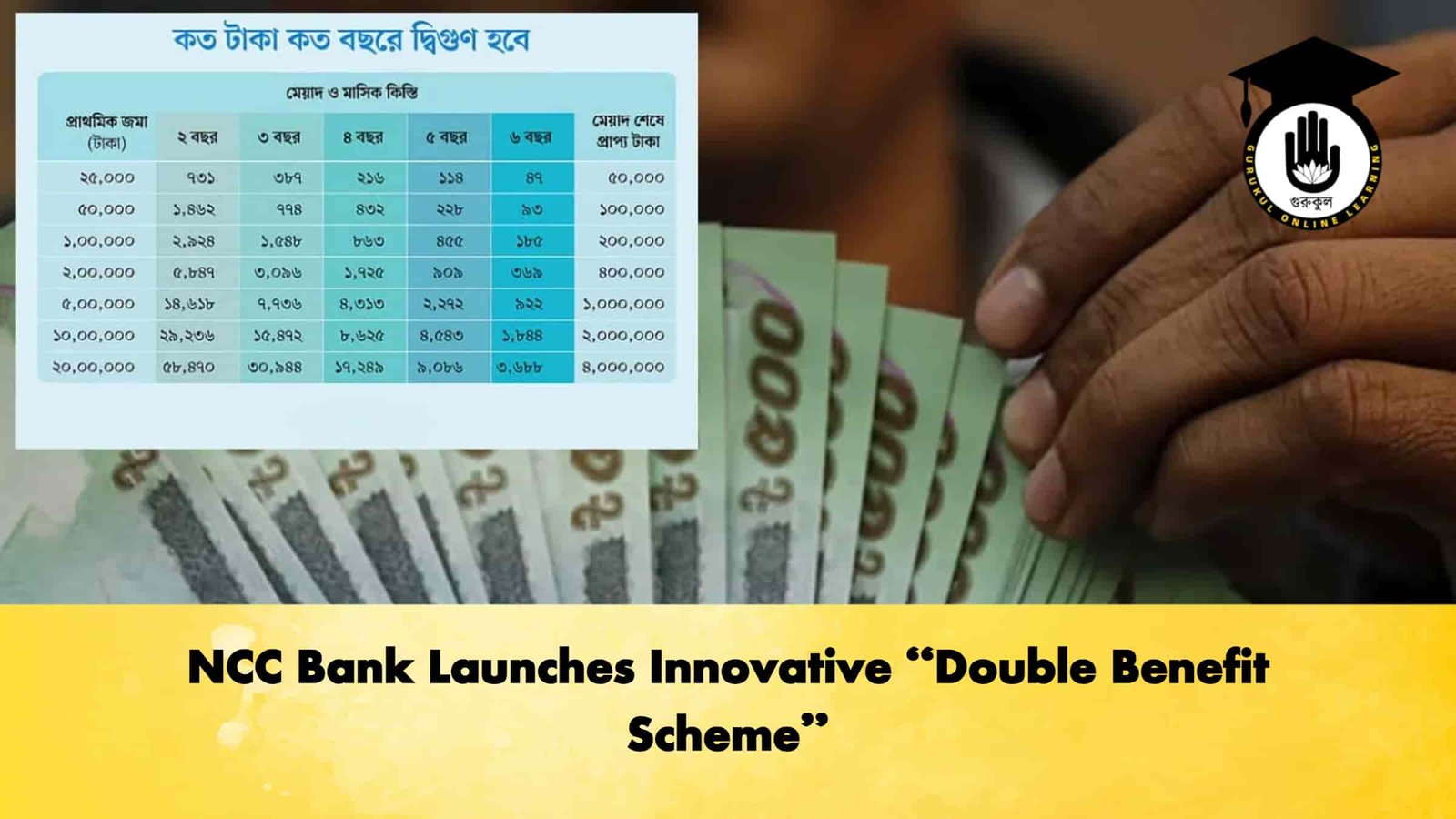

The NCC Bank scheme addresses this concern by combining an initial deposit with manageable monthly instalments. According to the bank, the minimum initial deposit starts at BDT 25,000, while the maximum can go up to BDT 2,000,000. Customers can choose a tenure ranging from two to six years, with a fixed interest rate of 10% per annum.

For example, a customer wishing to double an initial deposit of BDT 25,000 over two years would need to contribute BDT 731 per month. Extending the term reduces the monthly instalment requirement: over three years it falls to BDT 387, over four years to BDT 216, over five years to BDT 114, and over six years to just BDT 47.

The table below summarises the monthly instalments for different initial deposits and tenures:

| Initial Deposit (BDT) | 2 Years | 3 Years | 4 Years | 5 Years | 6 Years |

|---|---|---|---|---|---|

| 25,000 | 731 | 387 | 216 | 114 | 47 |

| 50,000 | 1,462 | 774 | 432 | 228 | 93 |

| 100,000 | 2,924 | 1,548 | 863 | 455 | 185 |

| 200,000 | 5,847 | 3,096 | 1,725 | 909 | 369 |

| 500,000 | 14,618 | 7,736 | 4,313 | 2,272 | 922 |

| 1,000,000 | 29,236 | 15,472 | 8,625 | 4,543 | 1,844 |

| 2,000,000 | 58,470 | 30,944 | 17,249 | 9,368 | – |

Customers may open multiple accounts if desired, and monthly instalments can be deposited directly or through a linked savings account. Account balances can be conveniently monitored via the bank’s internet banking services.

To open an account, applicants need to provide a personal photograph, a valid National ID (NID), nominee details including a photograph and NID, the identity of a referee at the bank, and the contact information of a responsible person for emergencies. All required signatures must be provided on the designated form.

Financial experts note that in developing countries like Bangladesh, uncertainties such as medical emergencies or accidents can impose severe economic strain. They emphasise that structured savings and responsible financial planning are essential to mitigate future risks. Regular savings not only enhance financial security but also foster self-reliance and long-term stability.