Aggressive credit expansion by private commercial banks has significantly heightened systemic risk within the country’s banking sector, according to a recent analytical report by the Bangladesh Bank. The study identifies three principal stress factors: lending beyond regulatory ceilings, a sustained rise in non-performing loans, and a marked deceleration in deposit growth. Together, these trends have exposed fragilities in liquidity management, particularly among private and Islamic banks.

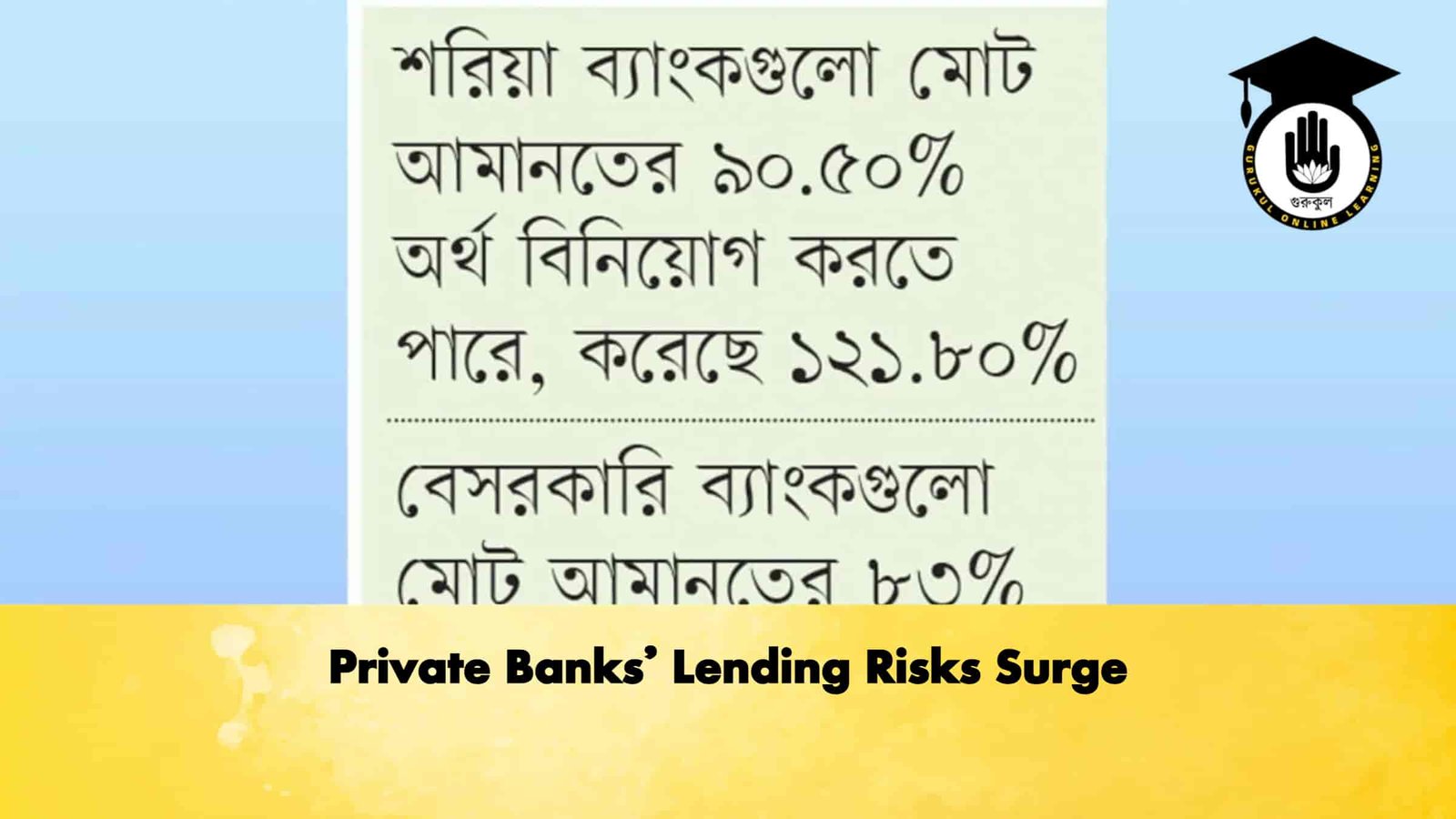

Under prevailing prudential regulations, conventional banks are permitted to extend loans up to 83 per cent of their total deposits. The remaining 13 per cent must be maintained as statutory reserves with the central bank to safeguard depositor interests. In contrast, Islamic banks are required to maintain 9.5 per cent of their deposits as statutory reserves, allowing them to invest up to 90.5 per cent. In addition, all banks must hold supplementary cash reserves to meet daily settlement and payment obligations.

The report, however, reveals widespread non-compliance among private and Islamic institutions. On average, private commercial banks have lent 94.10 per cent of their deposits—exceeding the permissible ceiling by 11.10 percentage points. The situation is considerably more acute among Islamic banks, which have invested 121.80 per cent of their deposits, surpassing the authorised threshold by 31.30 percentage points. This excess exposure has reportedly been financed through interbank borrowing and recourse to the debt market, practices that heighten leverage and undermine financial discipline.

A comparative summary of loan and investment ratios across bank categories is presented below:

| Bank Category | Loan/Investment-to-Deposit Ratio (%) | Regulatory Limit (%) | Excess/Shortfall (%) |

|---|---|---|---|

| Private Commercial Banks | 94.10 | 83.00 | +11.10 |

| Islamic Banks | 121.80 | 90.50 | +31.30 |

| State-Owned Commercial Banks | 71.70 | 83.00 | –11.30 |

| Specialised State-Owned Banks | 87.00 | 83.00 | +4.00 |

| Foreign Commercial Banks | 55.30 | 83.00 | –27.70 |

By contrast, state-owned and foreign banks remain broadly within regulatory parameters. State-owned commercial banks report an average loan ratio of 71.70 per cent, while foreign banks maintain a conservative 55.30 per cent. Consequently, liquidity risk in these segments appears comparatively contained.

Sector-wide, the average loan or investment ratio stands at 86.90 per cent. Nevertheless, analysts caution that persistent breaches by a subset of institutions could destabilise the broader financial system. Rising non-performing loans are compounding liquidity pressures, as delayed recoveries restrict cash inflows and weaken depositor confidence.

Financial experts argue that restoring discipline through enhanced supervisory oversight and stricter enforcement of exposure limits is essential. Without corrective action, elevated credit concentration and leverage may amplify systemic vulnerabilities in the medium term, potentially constraining credit flows and undermining macro-financial stability.