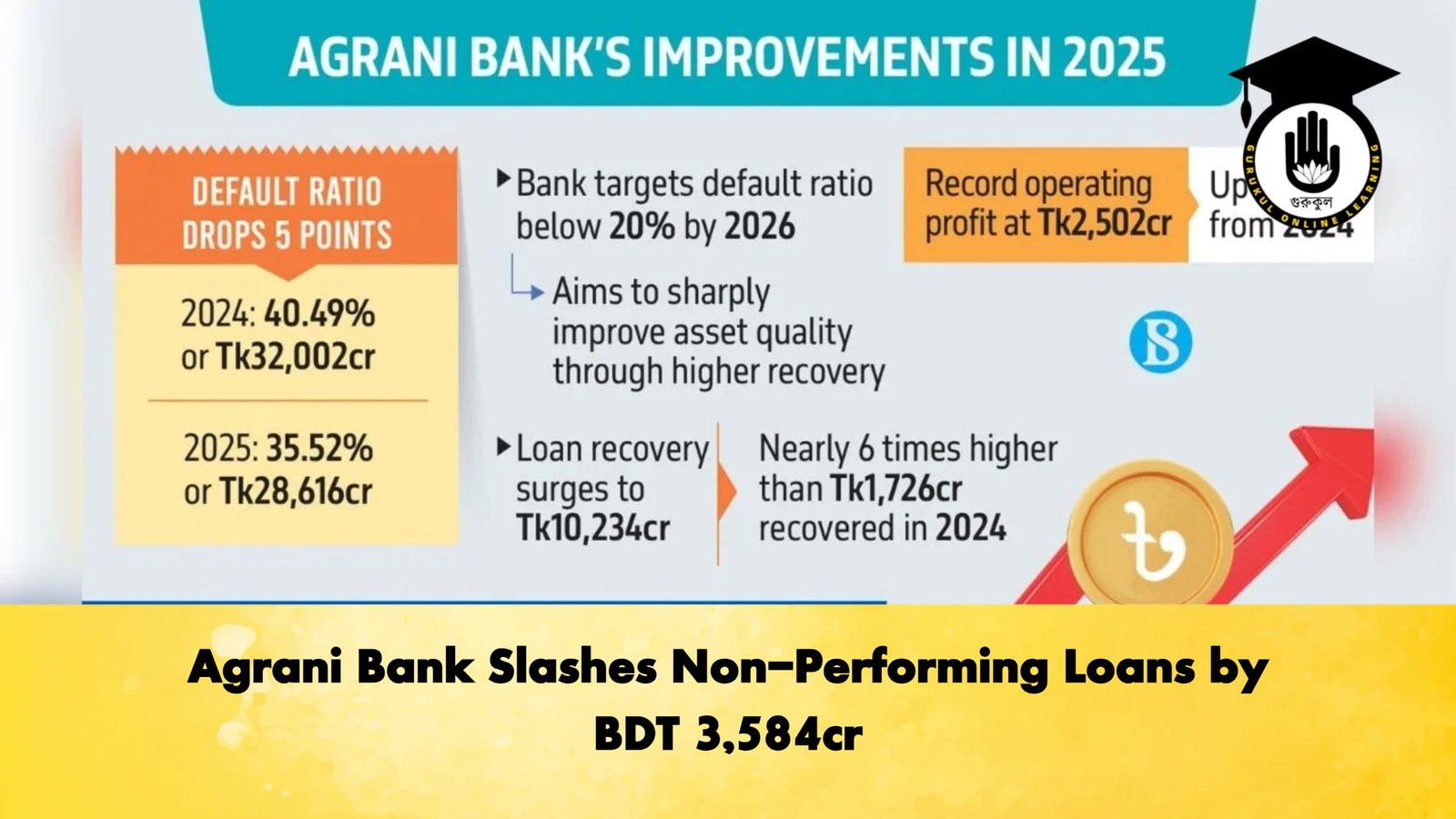

In a year defined by rigorous fiscal discipline, the state-owned Agrani Bank has successfully excised a substantial portion of its toxic debt, reducing its volume of defaulted loans by BDT 3,584 crore during 2025. This turnaround is a cornerstone of a broader, government-led initiative to sanitise the balance sheets of public sector banks and restore public confidence in the national financial system.

A Transformation in Asset Quality

The bank’s Managing Director, Md Anwarul Islam, detailed the institution’s progress during a press briefing, noting that these efforts have compressed the defaulted loan ratio by nearly five percentage points within twelve months. At the close of 2024, Agrani Bank was grappling with a non-performing loan (NPL) ratio of 40.49%, representing BDT 32,002 crore. By the end of December 2025, that figure was successfully pared down to BDT 28,616 crore, or 35.52%.

“Upon assuming leadership, we implemented a suite of aggressive recovery initiatives,” Mr Islam noted. “While we are reaping the rewards of these measures, the journey is far from over. We have set a definitive target to drive the NPL ratio below 20% by the end of 2026.”

Record Profits and Diversified Growth

The bank’s robust recovery efforts have directly fuelled its most profitable year to date. Agrani Bank posted an all-time high operating profit of BDT 2,502 crore in 2025, a significant leap from the BDT 1,511 crore recorded in the previous year. This surge was primarily underpinned by a dramatic recovery from defaulters, which skyrocketed to BDT 10,234 crore—a nearly sixfold increase from 2024’s recovery of BDT 1,726 crore.

Comparative Financial Performance (2024–2025)

| Financial Metric | 2024 (BDT Crore) | 2025 (BDT Crore) | Variance (YoY) |

| Total Deposits | 99,232 | 113,064 | +BDT 13,832 cr |

| Operating Profit | 1,511 | 2,502 | +BDT 991 cr |

| Defaulted Loans (NPL) | 32,002 | 28,616 | -BDT 3,584 cr |

| Loan Recovery | 1,726 | 10,234 | +BDT 8,508 cr |

| Remittance Inflows | 21,033 | 33,961 | +BDT 12,928 cr |

| Import Financing | 50,588 | 54,367 | +BDT 3,779 cr |

| Export Financing | 14,114 | 13,252 | -BDT 862 cr |

External Sector Resilience

Beyond internal debt management, Agrani Bank emerged as a vital conduit for foreign exchange. Remittance inflows soared by BDT 12,928 crore to reach BDT 33,961 crore, reflecting heightened trust from the expatriate community. While import financing grew steadily to BDT 54,367 crore, the export sector faced slight contraction, likely due to global demand shifts.

The recovery breakdown for 2025 reveals a pragmatic approach: BDT 1,009 crore was recovered in cash, BDT 8,368 crore through structured rescheduling, and BDT 936 crore from written-off assets. For the coming year, the bank has set an ambitious recovery target of BDT 12,200 crore, aiming to further fortify its capital adequacy.