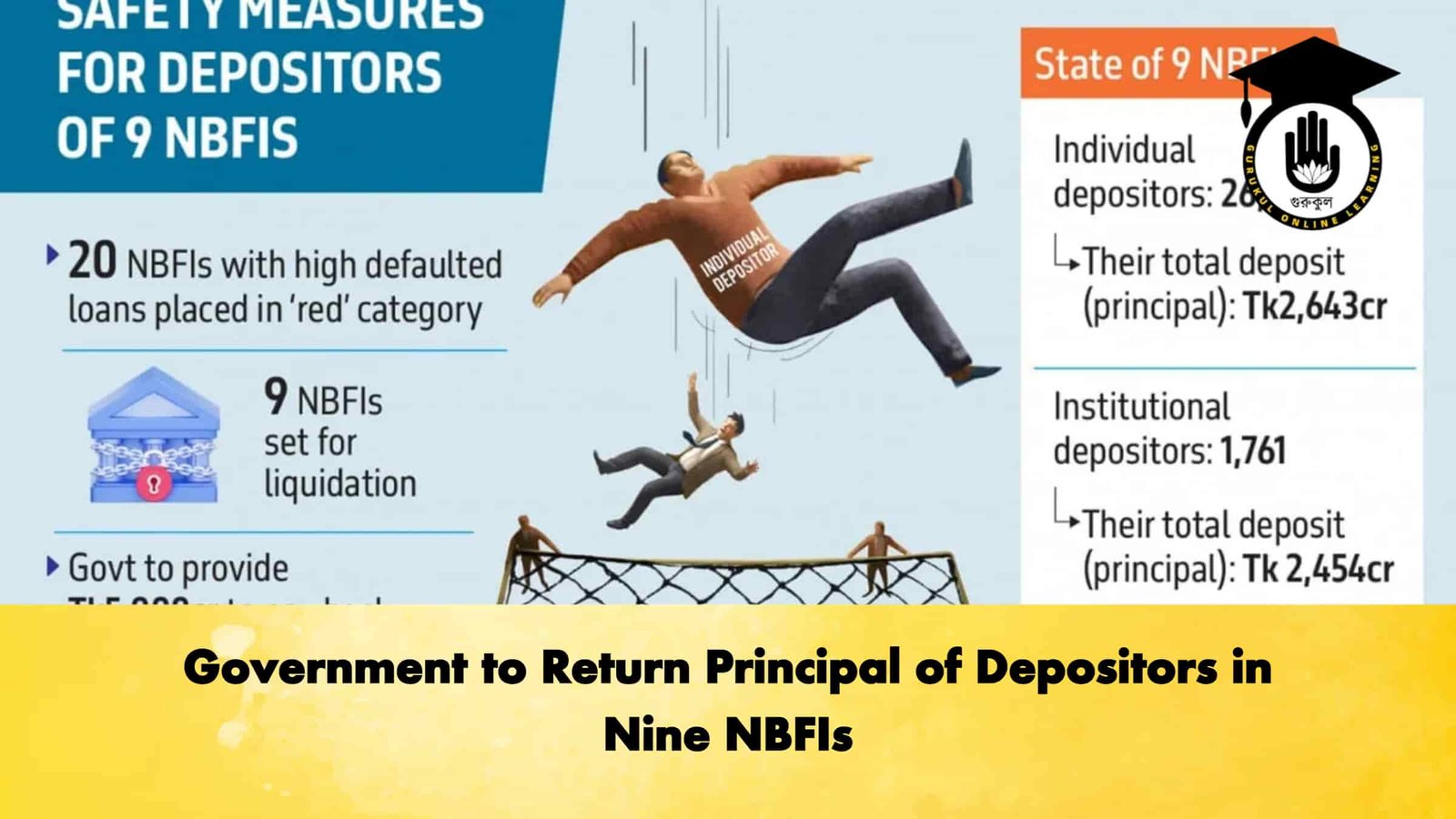

Individual depositors of nine non-bank financial institutions (NBFIs) facing insolvency will receive the full amount of their principal deposits, though no interest will be paid, as the government intervenes with a Tk5,000 crore support package to facilitate their liquidation. Bangladesh Bank Governor Ahsan H Mansur confirmed the measure, emphasising the distinction between individual and institutional investors.

Under the recently enacted Bank Resolution Ordinance 2025, the central bank has initiated the liquidation of the nine NBFIs after their financial positions deteriorated due to mounting loan defaults. Individual depositors will have their principal fully safeguarded, while institutional investors must rely solely on the proceeds recovered from the sale of assets.

“Individual depositors will get back their principal. Interest will not be paid,” Mansur stated. “Institutional depositors will receive whatever can be recovered through asset liquidation.”

The Bangladesh Bank will appoint a liquidator for each institution to evaluate assets, liabilities, and recoverable loans, properties, and investments. Proceeds from these sales will then be distributed to creditors. Mansur illustrated: “If Tk50 can be recovered against Tk100 of liabilities, institutional depositors will receive Tk50.”

Nine NBFIs Selected for Liquidation

The following nine institutions have been identified for immediate liquidation, based on the fiscal ceiling of Tk5,000 crore set by the government:

| Serial | NBFI Name | Status |

|---|---|---|

| 1 | FAS Finance | Show cause notice issued |

| 2 | Bangladesh Industrial Finance Company (BIFC) | Show cause notice issued |

| 3 | Premier Leasing | Show cause notice issued |

| 4 | Fareast Finance | Show cause notice issued |

| 5 | GSP Finance | Show cause notice issued |

| 6 | Prime Finance | Show cause notice issued |

| 7 | Aviva Finance | Show cause notice issued |

| 8 | People’s Leasing | Show cause notice issued |

| 9 | International Leasing | Show cause notice issued |

Previously, in January 2025, Bangladesh Bank had classified 20 NBFIs as financially distressed due to high non-performing loans and eroded capital. The initial nine were selected to keep the government’s fiscal exposure within the Tk5,000 crore limit.

Bangladesh’s deposit insurance scheme currently covers up to Tk2 lakh per depositor. However, NBFIs had only recently been brought under the amended ordinance and had not yet contributed to the fund. Consequently, the government has opted to protect depositors directly during this liquidation round. From this year, all NBFIs will begin contributing to the insurance fund, ensuring parity with bank deposit protection.

Mansur indicated that the liquidation process has already begun. Show cause notices have been served to all nine institutions, giving them a chance to explain why they should not be declared dysfunctional. “If satisfactory responses are not provided, we will formally declare them insolvent and appoint liquidators,” he said.

According to the governor, Bangladesh Bank’s assessments found no viable path to restore these institutions’ solvency, signalling minimal prospects of recovery for institutional creditors.