Over Tk 549 crore has been sitting idle for more than a year in an account belonging to a suspected shell company linked to the S Alam Group. However, both investigators and officials from Islami Bank are unable to trace the account holder. The account, named “Top Ten Trading House,” was opened on April 13, 2023, at Islami Bank’s Khatunganj branch in Chattogram. According to bank documents, the account owner is listed as Almas Ali, with a registered address at 23/5 Gopalbagh Residential Building, Jatrabari, Dhaka.

Despite six formal notices served to the account holder over the past year, the individual has not appeared at the bank. Bank officials have also visited the listed addresses, but they failed to verify the existence of Almas Ali, raising serious questions about who actually opened the account.

Muhammad Jamal Uddin, Senior Vice President and Head of Islami Bank’s Khatunganj branch, commented, “The owner of this account has never come to the bank. In fact, we could not confirm if he is a real person.” Jamal also revealed that several groups allegedly linked to S Alam Group had attempted to withdraw funds from the account using fake vouchers and cheques. They even offered bribes to bank officials, though Jamal refrained from naming those involved.

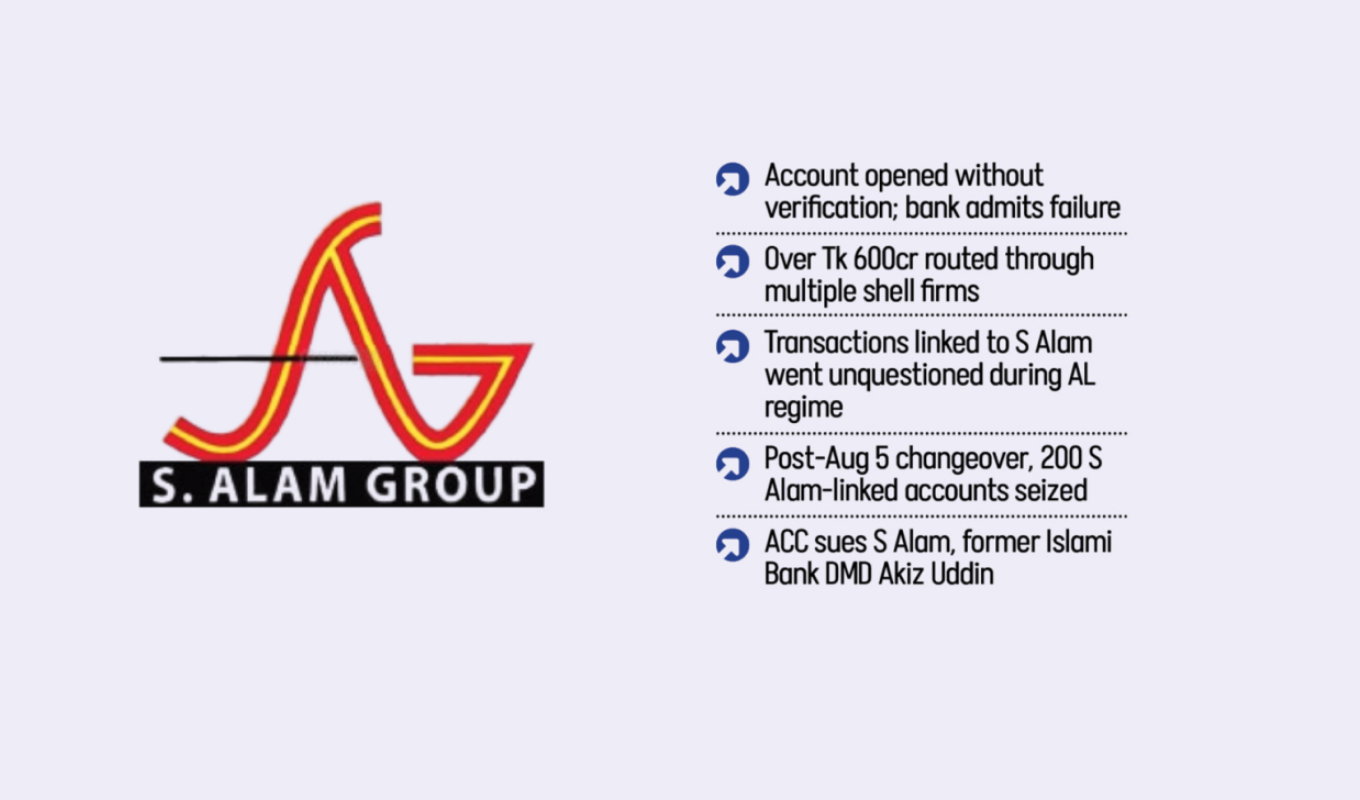

“When the account was opened, I was not at this branch. However, officials who were present at the time stated they were pressured to open the account without following proper procedures or verifying documents,” he added.

ACC Lawsuit and Further Investigations

The Anti-Corruption Commission (ACC) has taken up the investigation, and in its findings, two additional shell companies – Alam Trading & Business House and Gold Star Trading House – were also identified as linked to the S Alam Group. The investigation revealed that funds were regularly deposited into the Top Ten account from several S Alam subsidiaries, including S Alam Super Edible Oil Ltd, Sonali Traders, S Alam Edible Oil Ltd, and S Alam Sugar Refinery Ltd.

On August 18, ACC Assistant Commissioner Mahmudul Hasan filed a case at the commission’s Chattogram office concerning the suspicious account. Among the suspects are the nominal owners of the three shell companies, S Alam Group Chairman Saiful Alam, former Deputy Managing Director Akiz Uddin, and former Executive Vice-President Miftah Uddin.

Islami Bank alerted the ACC about the irregularities in the account. In a letter to the National Board of Revenue (NBR), the bank admitted that it had not followed proper procedures when opening the account. The letter, dated October 18, highlighted how substantial sums of money were transferred into the account under the guise of payments to suppliers for the bank’s investment clients. The ultimate beneficiaries, however, were S Alam Group and some former bank officials who had facilitated these transactions.

Banking Irregularities and Fake Transactions

Documents from the bank and the ACC show that on January 17, 2024, Tk 20 crore was transferred from Top Ten’s account to Rabeya Enterprise at Southeast Bank, owned by Nasir Uddin, who is married to Akiz Uddin’s sister, Sharmin Akter.

The ACC’s investigation also uncovered a series of suspicious transactions aimed at laundering money. For example, on July 2, 2024, Tk 523.10 crore was withdrawn in cash from Alam Trading’s account at Islami Bank’s Agrabad branch. This amount was then deposited into the Gold Star Trading Company account through three pay orders, which were then routed to Top Ten’s account on August 6, 2024.

These transactions violated banking regulations, as the pay orders should have been deposited into the issuing company’s account, but instead were diverted to the Top Ten account, a practice identified as embezzlement and money laundering.

The shell companies Alam Trading and Gold Star Trading were found to be bogus entities. The individuals listed as their owners, Nurul Alam (Alam Trading) and Bedarul Islam (Gold Star Trading), could not be traced, as their mobile numbers were switched off.

Frozen Accounts and Further Investigations

Both Alam Trading and Gold Star Trading accounts, which had transactions worth over Tk 2,000 crore, have been frozen under instructions from Bangladesh Bank. However, a senior bank official noted that most of the funds were withdrawn before the freeze, leaving only around Tk 2 crore remaining.

According to Islami Bank officials, during the Awami League’s 15-year rule, bank employees could not question any transactions involving S Alam Group. However, since the political shift in August 2024, more than 200 suspicious accounts linked to S Alam Group have been seized.

Muhammad Jamal Uddin, Senior Vice President of Islami Bank, added, “S Alam-linked companies embezzled around Tk 52,000 crore from Islami Bank through shell firms disguised as loans. Deposits in Top Ten Trading’s account were also sourced from such loans. Steps are now being taken to adjust these funds against outstanding liabilities.”

Key Facts:

| Item | Details |

|---|---|

| Total Funds in Suspicious Account | Tk 549 crore |

| Date Account Opened | April 13, 2023 |

| Account Holder (Nominal) | Almas Ali |

| Shell Companies Linked | Alam Trading & Business House, Gold Star Trading House |

| Amount Withdrawn (July 2, 2024) | Tk 523.10 crore |

| Amount Deposited (Aug 6, 2024) | Tk 544 crore |

| Total Suspicious Transactions | Over Tk 2,000 crore |

| Accounts Frozen | Alam Trading, Gold Star Trading |

The investigation is ongoing, with more developments expected as the ACC continues to probe the links between S Alam Group and various shell companies.