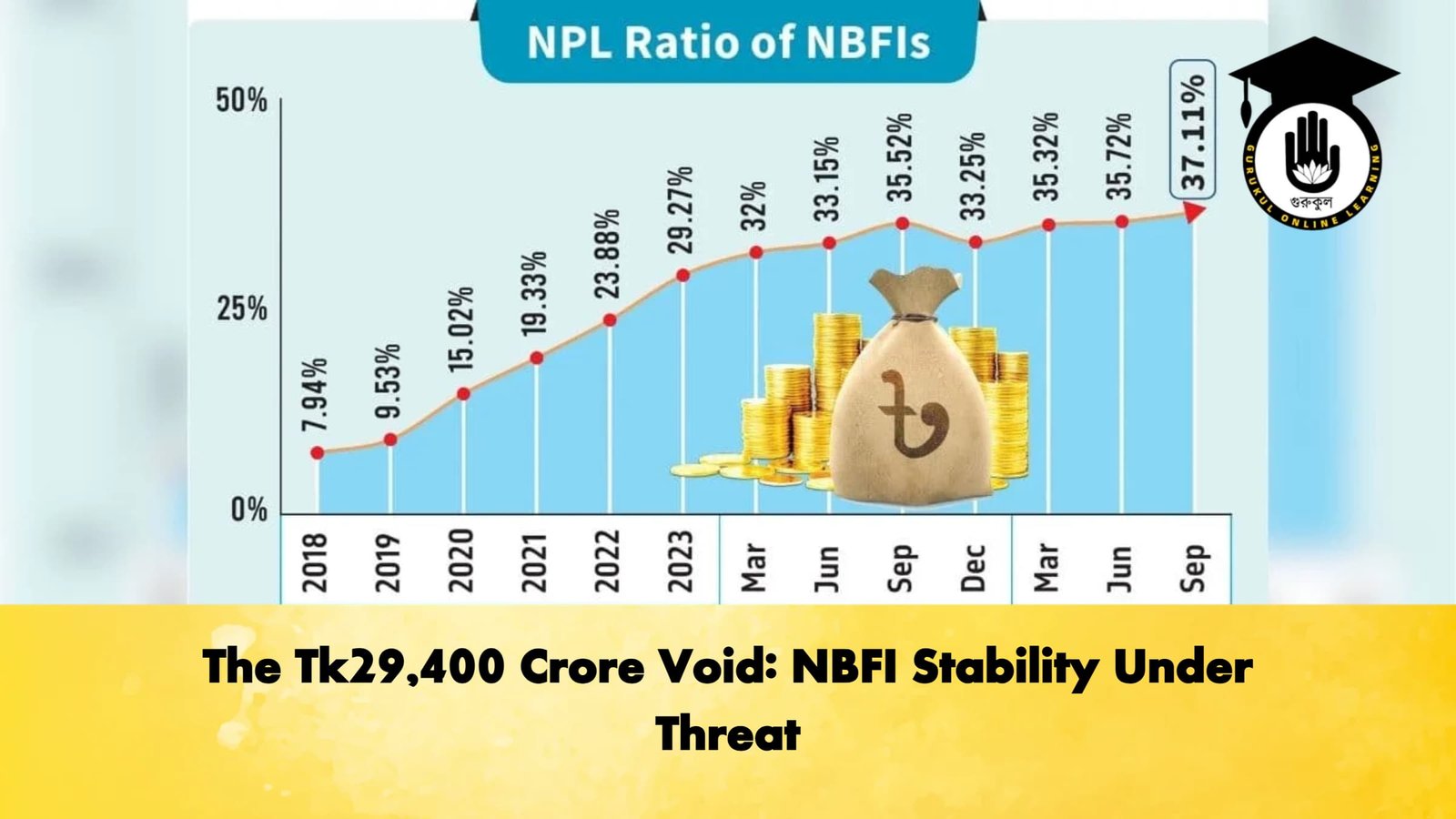

The stability of Bangladesh’s Non-Bank Financial Institution (NBFI) sector has reached a perilous nadir, with Non-Performing Loans (NPLs) escalating to a staggering Tk 29,408 crore by the end of September 2025. This mountain of bad debt now accounts for 37.11% of the sector’s total outstanding credit, highlighting a systemic failure in asset quality and a profound erosion of institutional trust.

A Rapid Quarterly Decline

Data released by the Bangladesh Bank paints a picture of a sector in freefall. Between June and September 2025, classified loans surged by Tk 1,867 crore in a mere 90 days. This indicates that the “contagion” of default is no longer confined to legacy accounts; even contemporary credit disbursements are failing to perform, dragging the industry deeper into a liquidity trap.

Comparative Analysis: The Widening Credit Gap

The following table demonstrates the aggressive growth of bad debt relative to total lending:

| Financial Indicator | June 2025 | September 2025 | Net Variance |

| Total Outstanding Loans | Tk 77,094 cr | Tk 79,251 cr | +2.80% |

| Classified Loans (NPLs) | Tk 27,541 cr | Tk 29,408 cr | +6.78% |

| Non-Performing Ratio | 35.72% | 37.11% | +1.39 pts |

| Total Sector Assets | Tk 100,721 cr | Tk 99,493 cr | -1.22% |

Lifting the Veil on Hidden Defaults

The sudden surge in NPL figures is partly attributed to a rigorous “house-cleaning” exercise by the central bank following the change in national administration on 5 August 2024. Golam Sarwar Bhuiyan, Chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA), clarified that these losses were long concealed through creative accounting and perpetual rescheduling.

“The bad loans were always there, hidden in the shadows,” Bhuiyan remarked. “Under new management, the central bank has enforced a policy of transparency, forcing companies to admit the true extent of their exposure.” He further noted that many high-profile borrowers—often those with political ties—have fled the country, causing their multi-million-taka portfolios to be classified as defaults overnight.

Survival of the Fittest: Liquidations and Panic

The central bank’s decision to liquidate nine terminally ill institutions—including FAS Finance, BIFC, and International Leasing—has sparked a contagion of fear among retail depositors. As confidence evaporates, NBFIs are struggling to secure the fresh deposits necessary to roll over existing debt.

The government has earmarked a Tk 5,000 crore fiscal ceiling to manage the fallout of these liquidations, but the sector’s total assets have already begun to contract, falling by over 1.2% in the last quarter alone. With profitability at an all-time low and the cost of funds rising, the NBFI sector faces a grim reality: a radical consolidation is no longer a choice, but an inevitable consequence of years of mismanagement.